What is Tax Code 280E?

Cannabis businesses face constant restrictions — from banking to website administration — for the simple act of selling a plant.

On December 30, 2022, Republican Representative Nancy Mace of South Carolina introduced an amendment for the Internal Revenue Service (IRS). The purpose was “to allow deductions and credits relating to expenditures in connection with marijuana sales.”

While it was apparent this would expire before the session ended 11 days later, this was the latest in a long line of similar efforts. The wheels of legislation turn slowly, and it often requires several of these attempts before there’s any real progress.

Let’s discuss this effort, why it matters, and how cannabis businesses are hurting for change.

What is Tax Code 280E?

Originally instated in the ’80s to prevent drug traffickers from writing off expenses related to their illicit field, tax code 208E is the nightmare of cannabis businesses. The language of the code states:

No deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business. … consists in tracking in a controlled substance (within the meaning of Schedule I and II of the Controlled Substances Act.)

Any revenue businesses earn as a result of a substance on the list of schedule I or II controlled substances cannot be claimed as a deduction.

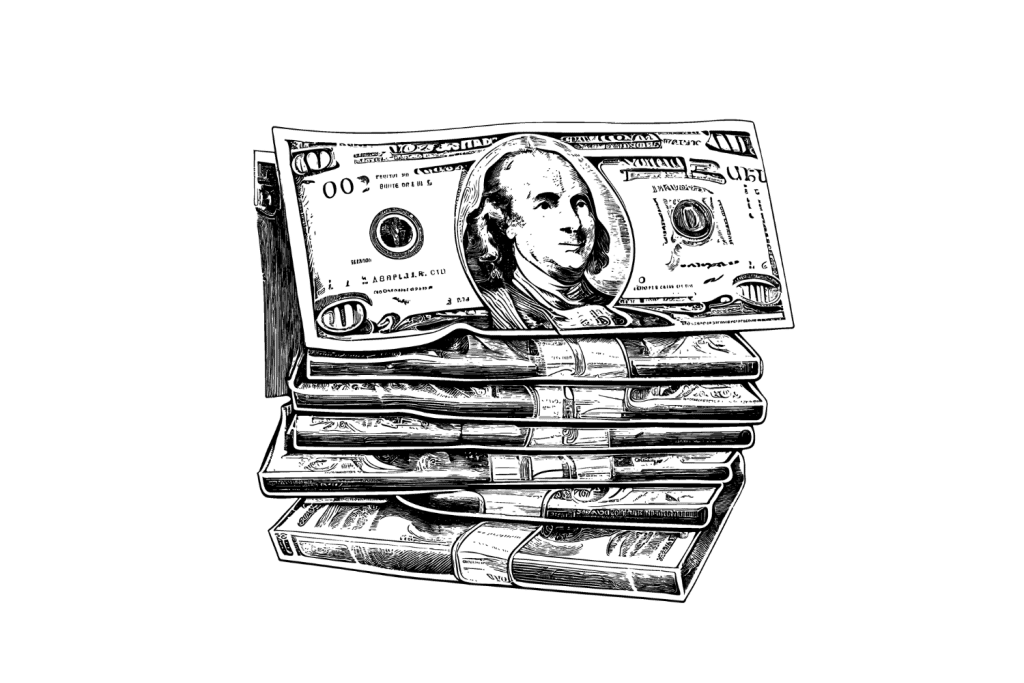

Standard deductions small businesses can take advantage of include the following:

- Salaries for your employees

- Health Benefits

- Office Supplies

- Counters, products, and other physical elements of the store

- Signage

- Rent and utilities

- Furniture for the office or retail outlet

- Software and services related to business operations

This list is not exhaustive — virtually every dollar small business owners put into their businesses is deductible from taxes. At the end of the year, they can take that amount away from their earnings and not pay for revenue they didn’t get to enjoy.

This isn’t the case for cannabis businesses, however.

What Makes the Tax Code 280E Problematic?

The current issue with this law is that marijuana is still a schedule I narcotic under the Controlled Substances Act. This category — supposedly for drugs with no medicinal value and a high potential for abuse — makes every legal dispensary a “trafficker” of a controlled substance.

At the close of 2021, adult-use cannabis sales alone accounted for a combined total of $10.4 billion in tax revenue for the United States. Yet the businesses responsible for bringing all this money in suffer an undue burden due to the inability to deduct expenses.

Long ago, the government decided not to go after cannabis retailers in states that chose legalization. Yet they never removed the financial penalties they put in place for them because they never had the incentive to do so.

While the result is inequality, it’s toward businesses the government already has a poor opinion of. As a result, they don’t feel required to offer them the same tax incentives afforded to other companies.

Attempts to Repeal 280E

Different leaders have brought up tax code 280E throughout the years, but it’s never been taken very seriously. As far back as 2017, Congressman Jared Polis — a Democrat from the weed-centric state of Colorado — filed for amendments similar to the one Mace tried to push through.

Soon after Polis filed, Rep. Pete Sessions (R-TX) ensured it never made it to the floor. The result is almost always a refusal to acknowledge the potential, and it’s never resulted in any real change.

Some states — Pennsylvania, New Jersey, and New York, specifically — have workarounds for cannabis businesses to claim state tax deductions. This is a great start, but hardly answers the problem.

While it offers a tax break at the state level, businesses still don’t get the full tax benefit they are due.

Summary: What’s the Future of Tax Code 280E?

For now, all we can do is keep fighting for change. There is no clear movement toward removing this unfair law, but change is often about momentum.

The more times it comes up on the floor, the more opportunities it has for someone to actually hear it. After it’s heard enough, eventually, it can gain the momentum to put the heavy arms of the law into motion.

It’s not a perfect system, but it’s the one we live with. Unfortunately, the ones getting left behind are often the ones at the forefront of one of the most dynamic and lucrative industries in the country.